Basic Prime Ltd, a company claiming to provide financial services, has been shut down following an investigation by the Insolvency Service after failing to deliver promised services and receiving around £175,000 from a client.

The company purported to offer trade finance guarantees and credit enhancement services but was suspected of operating an advance fee fraud scheme. It was never registered with the Financial Conduct Authority. In April 2024, Basic Prime Ltd agreed to arrange a financial guarantee worth $500m (approximately £382m) for a client. After the client paid an upfront fee of $231,000 (around £175,000), the company failed to deliver the guarantee and ceased responding by September 2024.

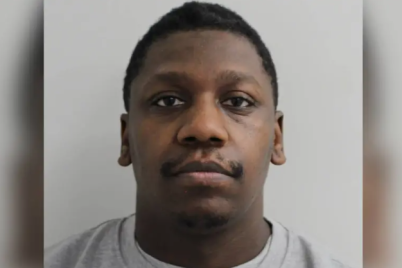

Basic Prime Ltd was wound up at the High Court in London on 25 November. Mark George, chief investigator at the Insolvency Service, said: “Basic Prime Ltd presented itself as a legitimate financial services provider, but our investigation revealed a company that took substantial fees without delivering services. The company operated with no transparency, maintaining a registered office where it had no actual presence and providing contact details that were not in service. The director failed to respond to any of our enquiries or provide any business records. This case demonstrates our commitment to protecting the public from fraudulent operators. Companies that take money under false pretences and then disappear will not be allowed to trade.”

Incorporated in October 2023, Basic Prime Ltd claimed to offer financial advisory services, asset management, and loan and credit consultancy. Its website indicated specialisation in credit enhancement, project finance, and payment guarantees using standby letters of credit and bank guarantees.

Investigators discovered that the company had no presence at its registered Croydon office, which was a managed office space. The sole director could not be contacted, and letters sent to addresses linked to the director were returned. Listed email addresses and telephone numbers were inactive.

The investigation also revealed discrepancies in the company’s filings. Basic Prime Ltd claimed £1m in paid-up share capital at incorporation, but accounts suggested this capital was never paid. Despite receiving the client’s $231,000 fee, the company filed dormant accounts showing no trading activity. Additionally, the company misrepresented its banking arrangements, claiming to hold an account with a major bank, which the bank confirmed did not exist.

Basic Prime Ltd and its director failed to provide requested information or business records, preventing investigators from establishing the company’s actual operations, financial position, or extent of trading activities. The Official Receiver has now been appointed as liquidator.